Your Trusted Insurance Agency for Contractors & Blue-Collar Businesses

Affordable, reliable insurance solutions for contractors and blue-collar professionals. Secure your coverage today.

About BLUE COLLAR INSURANCE SERVICES

Insurance Built for Hardworking Blue Collar Professionals

Blue Collar Insurance Services specializes in providing insurance solutions for contractors and blue-collar businesses. Our mission is to offer straightforward, affordable coverage to protect your livelihood. Based in Carlsbad, California, we proudly serve businesses across the country.

- Industry-Specific Protection

- Affordable & Reliable

- Local Experts You Can Trust

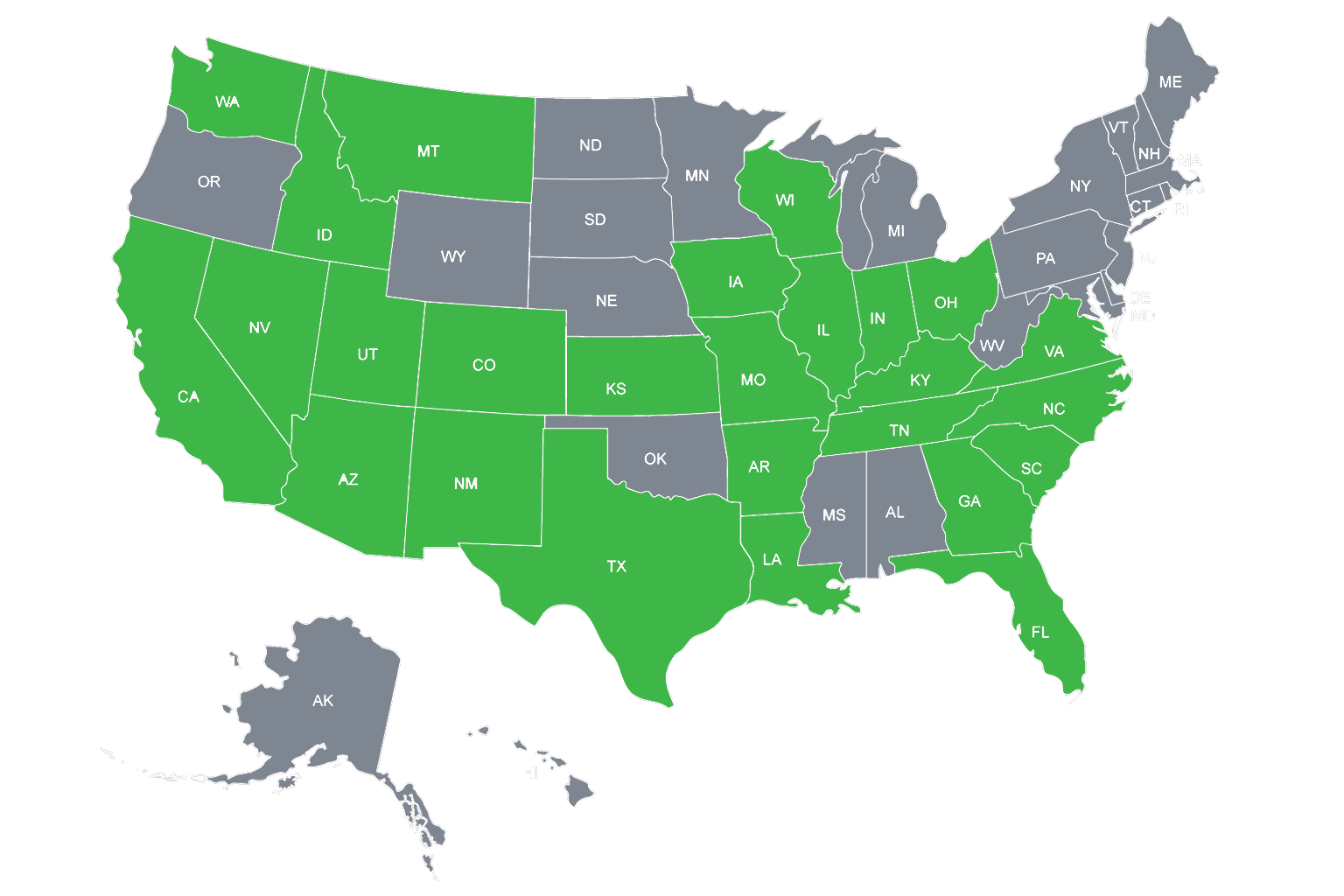

Nationwide Coverage

Proudly Serving Clients Across the Country

From coast to coast, Blue Collar Insurance Services delivers reliable coverage and real support. We help individuals and businesses protect what matters most with insurance solutions that work as hard as you do.

WHY CHOOSE BLUE COLLAR?

The Right Coverage. The Right Price. The Right Team.

We make insurance simple, affordable, and tailored for contractors and blue-collar businesses.

Insurance for Contractors & Trades

We specialize in coverage for blue-collar businesses, ensuring you get the right protection.

Fast & Easy Quotes

Get a hassle-free quote in minutes with a straightforward application process.

Affordable Coverage Options

Competitive rates designed to fit your budget without sacrificing protection.

Expert Guidance & Support

Work with professionals who understand your industry and insurance needs.

Trusted by Businesses Across the USA

A proven track record of helping contractors and small business owners stay protected.

TEAM MEMBER

Meet the Experts Protecting Your Business

Our team is dedicated to finding the best insurance solutions for contractors, tradespeople, and small business owners.

Business Insurance Solutions

Strong Coverage for Hardworking Contractor Businesses

Industries We Serve

Insurance Built for Your Contractor Business

Tailored coverage for contractors, tradespeople, and small business owners.

Fast, hassle-free insurance designed for contractors and small business owners.

A Simple Process to Get Covered

How to Get Insured with Blue Collar?

Get a Quote

Fill out a quick form or call us for a fast, no-obligation quote.

Customize Your Coverage

Work with our experts to choose the right policy for your needs.

Get Insured

Secure coverage quickly so you can focus on your business.

TESTIMONIALS

What Our Clients Say?

Frequently Asked Questions

Common questions clients asked about Blue Collar

Clear answers to help you understand your insurance options.

Stay informed with the latest insurance tips